But overtime can be a very confusing matter. 10 x ordinary rate of pay one days pay In excess of eight 8 hours-.

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Monthly rate of pay26 days Section 60I 1A EA.

. For holiday you should pay employee at rate 20 X for the first 8 working hours. The OT is calculated based on. The pay for overtime work shall be at a rate of not less than 1 ½ time of the employee hourly rate of pay.

For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows. 658 X 2 X 3. Employers are also prohibited from requiring or permitting an EA Employee to work overtime in excess of a total of 104 hours in any one month.

Malaysia Law On Overtime. If the employees salary does not exceed RM2000 a month or falls. All rates are hourly rate Please refer below for the default overtime calculation.

Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of overtime hours worked. Easy to read guide that answers all the important questions about employee benefits and employment law in Malaysia ie the Employment Act 1955 and others. Working in excess of normal working hours on a normal work day.

Here this would be RM625 x 15 x 2 hours RM1875. How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. Hourly rate of pay means the daily rate of pay divided by the normal hours of work as agreed between the employers and empoyees.

Information about recruitment in Malaysia to assist employers and HR to hire the right candidates that match their preferences. 30x triple amount of the salary. In Malaysia overtime is still popular among companies especially in the FB sector.

Section 2 1 defined wages as means basic wages and all other payments in cash payable to an employee for work done in respect of his contract of service but does not include. 15x hourly rate of. The key legislation in Malaysia related to employment matters is the Employment Act 1995 or EA 1995.

10x one day salary. However employers are also allowed to choose any other calculation basis which is more favourable to the employee eg monthly wages22 if the employee works 5 days a week. If a part-time EA Employee is required by hisher.

20x twice or double amount of the salary. 05 x ordinary rate of pay half-days pay More than half but up to eight 8 hours of work-. 7 Except in the circumstances described in subsection 2 a b c d and e no employer shall require any employee under.

The rights of workers who earn more than RM2000 per month are covered by the Contract Law as per the Contracts Act 1950. Shall not be construed as overtime work for the purposes of calculating 104 hours of overtime in any one month. 21 Calculation of Overtime Work.

15x hourly rate of pay. While overtime can be inevitable and has its limits it is an aspect of the job that can affect work-life balance motivation and performance. Normal working hours 1.

Overtime Rate according to Malaysian Employment Act 1955. The Minister may make regulations for the purpose of calculating the payment due for overtime to an employee employed on piece rates. Divide the employees daily salary by the number of normal working hours per day.

15x one and a half salary. RM1200 per month 26 days RM577 per hour X 2 RM5769 per day. The Act applies to employees whose salary is below RM2000 per month.

Overtime on Normal Working Day. 11 minutes Editors note. For staff members whose monthly salary is and any increase of salary where the OT is capped at the Company pays the following overtime rate which is in accordance to the rate provided by the Malaysian Employment Act 1955 as follows-a.

Working on Off-day 20 Basic pay 26 days X 20 X hour of works. Overtime entitlements under the Employment Act in Malaysia. Overtime payHourly rate X Overtime hours X Overtime rate.

In the app the daily rate of pay is divided by 8 hours. The ordinary rate of pay on a monthly basis shall be calculated according to the following formula. Must-know Malaysia Leave Types and Overtime Pay Rates is an article written by Nan An and further updated by Hern Yee from Talenox.

For guide on calculating hourly rate of pay kindly refer to Calculation for Overtime Payment. In this article we will study the laws governing the hours of work and overtime work for employees under Malaysias labour laws. Employee who works overtime on rest day not exceeding half hisher normal hours of work.

For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows. The Labor Law in Malaysia is regulated mainly by the Employment Act of 1955. Every 5 consecutive hours followed by a rest period not less than 30 minutes.

For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate. Basic pay 26 days X 30 X hour of works. As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours.

The Malaysian GDP grew at an average of 65 per annum for almost 50 years complemented by its amazing geographic location and multilingual mix of Malay Indian and Chinese populace. Normal working day 15 Basic pay 26 days X 15 X hour of works. Here is the formula and an example.

RM50 8 hours RM625. Working on Public Holiday. Process Overtime Days or Overtime Hours.

20 x hourly rate x number of hours in excess of 8 hours. Employee work 10 hours on rest day. In Malaysia matters concerning working hours and wages are regulated under the Employment Act 1955 and Minimum Wages Order 2016.

Working in excess of normal working hours on a normal work day. The Law governs the terms and conditions of employment such as working hours holidays and rest periods wages overtime and other employment conditions. If they work more than 8 hours on public holiday you need to pay them at rate 30 x for the balance overtime working hours.

The Employment Act provides that the minimum daily rate of pay for overtime calculations should be.

Your Step By Step Correct Guide To Calculating Overtime Pay

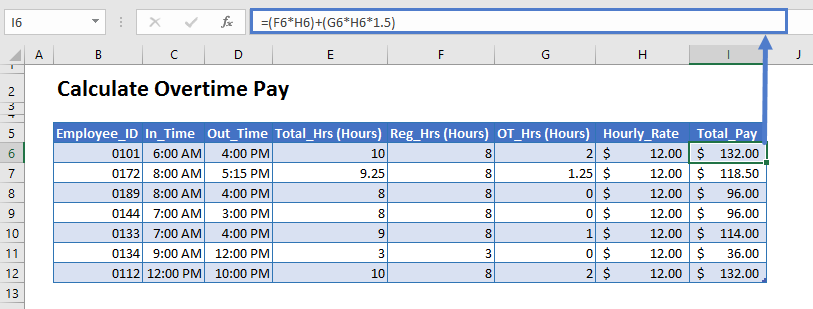

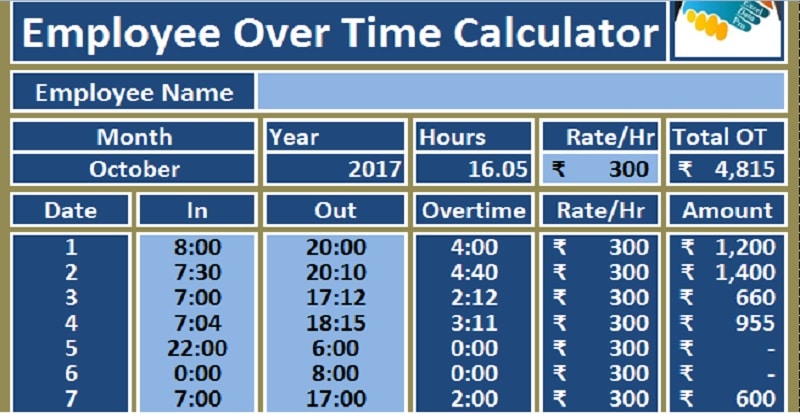

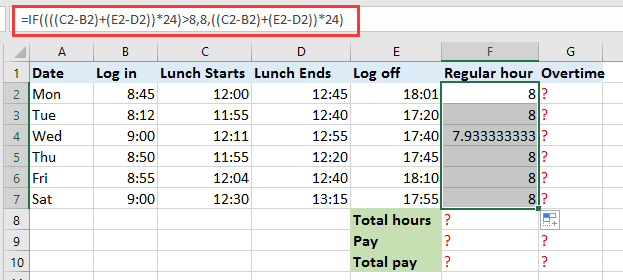

Excel Formula Basic Overtime Calculation Formula

Calculate Overtime In Excel Google Sheets Automate Excel

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Salary Calculation Dna Hr Capital Sdn Bhd

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Public Holiday Pay In Malaysia

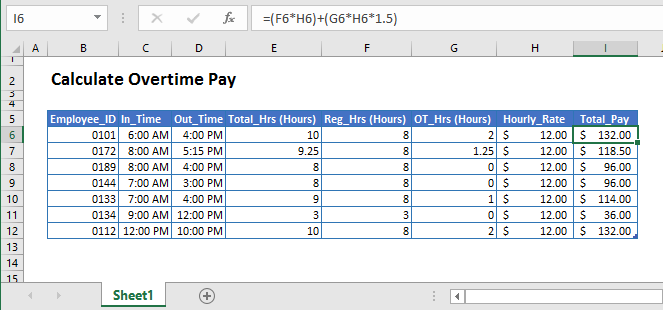

How To Quickly Calculate The Overtime And Payment In Excel

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Your Step By Step Correct Guide To Calculating Overtime Pay

Calculate Overtime In Excel Google Sheets Automate Excel

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Calculation Formula In Excel Youtube

Your Step By Step Correct Guide To Calculating Overtime Pay

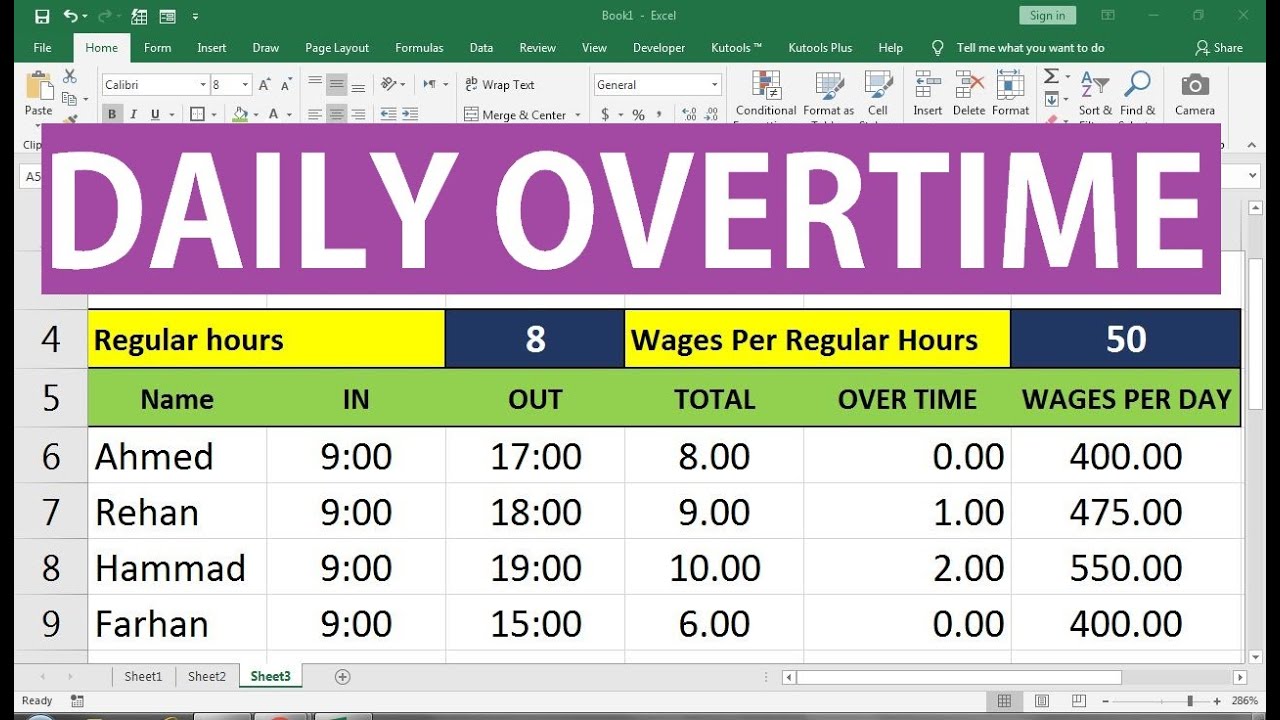

Download Employee Overtime Calculator Excel Template Exceldatapro

How To Quickly Calculate The Overtime And Payment In Excel